SPVs for Startups

.webp)

Special Purpose Vehicle

An SPV is a “special purpose vehicle”.

Essentially this is a catch all term for any legal structure created for the purpose of pooling money to make a specific investment (or series of investments), and decide how the returns are distributed.

In general, when you are using an SPV to make a syndicated investment (via a platform like Odin), you can only use it to invest in a single asset (not multiple assets). This is because in Europe you need to have fund management permissions to invest in multiple assets and make discretionary decisions on behalf of other people.

There are various forms an SPV can take. However, for the purposes of angel investing and VC, there are 3 common types you can create under UK law:

- A limited partnership run by a general partner ("GP-LP");

- A nominee (also known as a bare trust);

- A limited liability partnership (LLP).

A "GP-LP" set up is the most common structure for a fund. A fund is actually just a special type of SPV that is allowed to make investments in multiple assets. People also use GP-LP structures to invest in single assets.

It looks something like this:

Whilst you can use this structure to syndicate an investment in a single asset, it's a bit over-engineered for that purpose. This is because it has a lot of legal entities and associated admin (and cost).

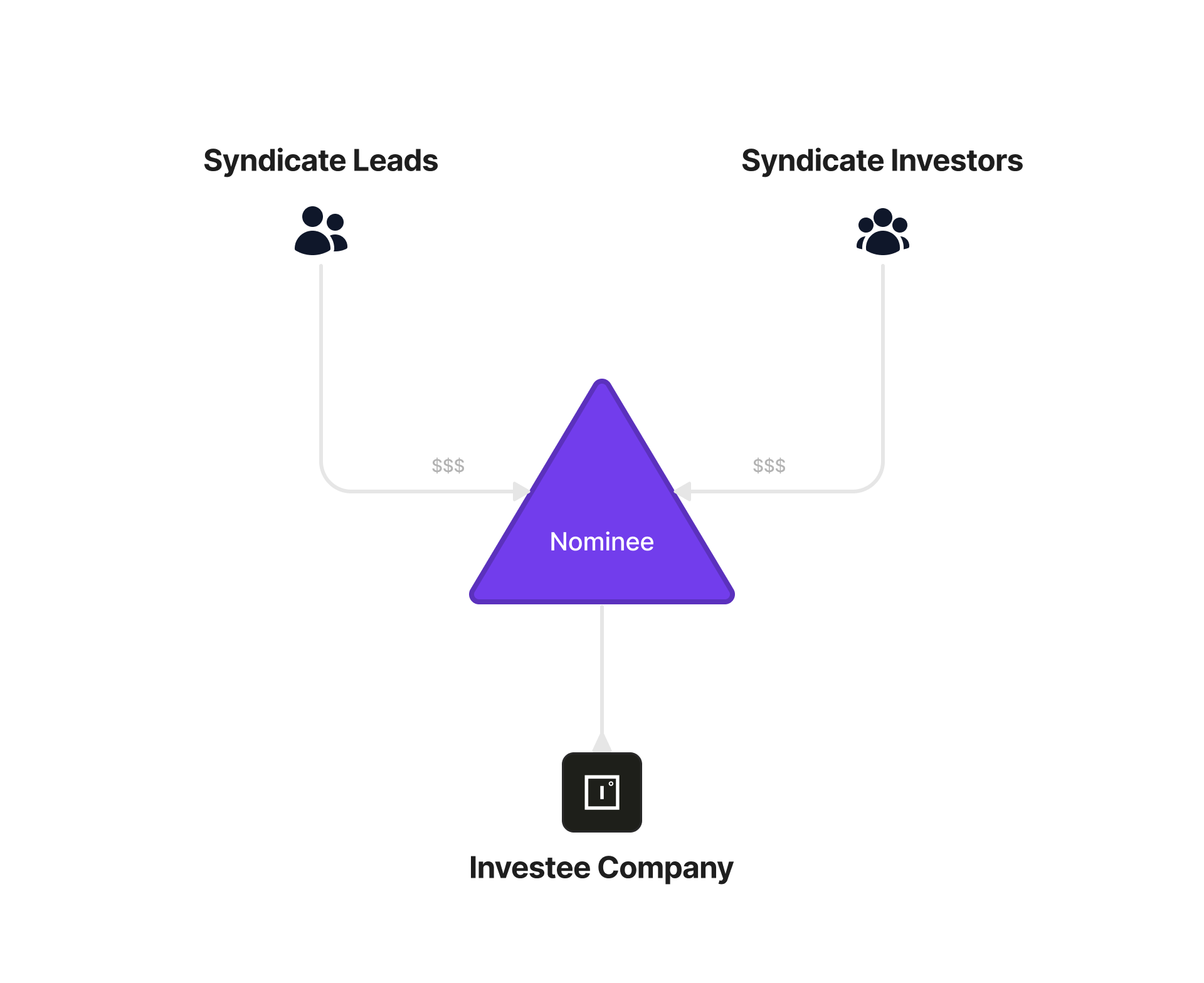

The Nominee: an alternative

At Odin, we use a nominee structure for our deals, because it is lighter, simpler, more cost-effective, usually just as tax efficient and, for our purposes, more scalable.

In this structure, you are essentially directly buying a portion of the underlying asset (eg. shares in a startup) and then nominating a non-trading limited company to hold these shares on your behalf. It’s different from the GP-LP structure where you are buying shares in the partnership, which is in turn buying the underlying asset.

You can invest via a nominee together with other people, so that from the perspective of the startup, they only deal with one investor; the nominee company. To them, it’s just like taking money from a fund.

Carried interest in this scenario is handled via a simple agreement between the investors and the syndicate lead. In the UK, this is still treatable as a capital gain in most cases.

You thus end up with many of the benefits of a full GP-LP fund without the complexity.

The nominee structure works for investors and investee companies almost anywhere, is tax transparent and carries no UK tax liability for non-UK investors. You can buy shares, convertible notes or almost any other instrument through this setup. It’s also very discrete, since there are no public filings with information on the underlying investors.

With the right paperwork, it also works for US investors, with no additional tax implications (we provide the right documents and handle FATCA obligations).

It also lets UK angels qualify for S/EIS tax relief, provided they are buying the right share class.

One of the best things about a nominee is that you can re-use the same legal entity for multiple, completely separate investments with different underlying investors. You can't do this with a limited partnership. This keeps per deal costs and admin down.

The UK is also an excellent place to run deals because the costs for company incorporation are low, and you can do almost everything digitally and incredibly fast. For example, it takes ~4 weeks to set up a company in Germany. In the UK, it takes 5 minutes.

I think the UK nominee structure wins hands down as the best SPV for deal by deal investing.

Which structure is right for me?

It is easy to get bogged down in acronyms and legalese.

Remember, whatever structure you use to syndicate a deal, you are only really trying to address five problems:

- Simplicity

Does creating this structure simplify everything for you as the dealmaker, for the investors, and for the people managing the investee company? How much work is involved in things like regulatory filings and reporting once the vehicle is set up? - Governance

Deciding who makes what decisions around deployment of capital, management of the asset when it comes to investor consent, and any rules or restrictions that apply. - Tax efficiency

Deciding how and when profits will be paid out, and minimising the taxes that will be paid on those distributions for all participants. - Cost

Figuring out how to make the structure itself cost-effective to set up and run. - LP comfort: compliance, familiarity & discretion

Ensuring you aren't breaking the law, ensuring the investors in the vehicle trust & understand the structure. Allowing people to invest without their personal information being disclosed or publicly available is a plus.

Your choice of SPV depends on the extent to which you value each of these considerations. The table below gives you a quick overview of the 3 most popular and their pro's and cons, based on our experience in the UK.

At Odin we are laser focused on providing:

- A great customer experience

- A community around you to help grow your syndicate

- Capital efficiency (cost, tax efficiency)

And we aim to do these three things better than anyone else in the market.

For our purposes, the nominee is the best SPV structure.

Use Cases

Here are some of the ways you can use an Odin SPV:

- Run your angel syndicate

You can run a community of investors that invest deal by deal in individual companies (or funds) via an Odin entity. This makes it easier to meet minimum ticket sizes, and spread your risk. You can charge carry, and vary this on an investor by investor and deal by deal basis. You can also share carry with other investors in the syndicate who add value on a specific deal. - Join forces with other angels

- For larger ticket angel investors, meeting minimum cheque sizes isn’t always an issue. But aligning and investing together in order to increase your control and bargaining power in a deal is not always a bad idea. Strength in numbers can help when there are important governance matters requiring investor consent as the company grows.

- Roll up your own investors (as a founder)

Founders can use Odin to roll up multiple investors into a single legal entity. You can also proxy voting to one person, which saves you a lot of administrative headache in the future. - Invest in a venture capital fund

You can pool multiple investors via an Odin SPV and invest as a single LP in a VC fund, where the minimum cheque size might be too high for you to invest directly. - Invest in some other sort of asset

Want to arrange a syndicate of investors to buy and hold a house, a pair of collectible trainers or a piece of art? You could syndicate an investment via an Odin SPV into a company. That company would then purchase and pay for the management (or safe storage) of the asset. Using an Odin vehicle in the middle makes it easier to handle things like fractional ownership and secondary sales of shares in future. This isn’t our current focus, but it’s possible!

If you’re interested in finding out more, check out our site.